Corporate tax planning is a means of reducing tax liabilities on a registered company. Through the various tax deductions and exemptions provided under the Income Tax Act, a company can substantially reduce its tax burden in a legal way

Blog 1

Corporate tax planning is a means of reducing tax liabilities on a registered company. Through the various tax deductions and exemptions provided under the Income Tax Act, a company can substantially reduce its tax burden in a legal way

Tax planning is the process of analysing a financial plan or a situation from a tax perspective. The objective of tax planning is to make sure there is tax efficiency. With the help of tax planning, one can ensure that all elements of a financial plan can function together with maximum tax-efficiency.

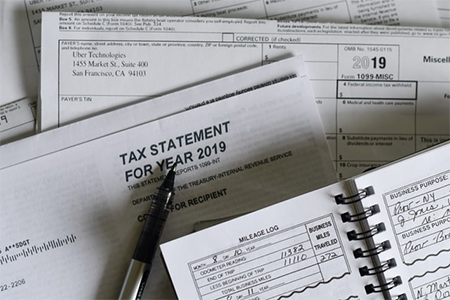

Recording your income and expenses isn’t a difficult task (you don’t need an accounting background or to be “good with numbers”), but it does take time and effort. How you do it depends on your personal preference. You can hire an expert to do it all, do it yourself or combine the two, using an expert to help you from time to time.

Most of the businesses are required to collect and remit Sales tax to CRA. We assist you to calculate, compile sales tax returns for your business in timely and efficient manner. We also help you in maximizing your Input Tax Credits to lower your sales tax remittance.

Canada is the second-largest country in the world by land area, split into 10 provinces and three territories. With a GDP of nearly $2 trillion in 2020, Canada has a robust economy with workers in a variety of critical industries. Companies looking to hire remote workers in Canada will find plenty of talent in tech, finance, health, professional services, and a variety of other industries. Thanks to its abundant resources, Canada is also home to thriving businesses in agriculture, mining, forestry, and construction.

To register as a corporation, you will need to: incorporate your business (obtain your articles of incorporation) through federal incorporation or provincial/territorial incorporation. get a federal business number and Corporation income tax account from the Canada Revenue Agency.